Nearly 75% of respondents reported having experienced online fraud, suggesting that the epidemic has sped up the pace of cybercrime. In addition, the OLX India Safer Internet Day Survey found that over 47% of respondents had suffered financial theft. The poll also revealed that social media use and online shopping were the top two activities that made respondents feel uncomfortable online. One in five respondents who are over 50 described the consumption of online content as potentially dangerous.

Lost 72k while buying a car on OLX

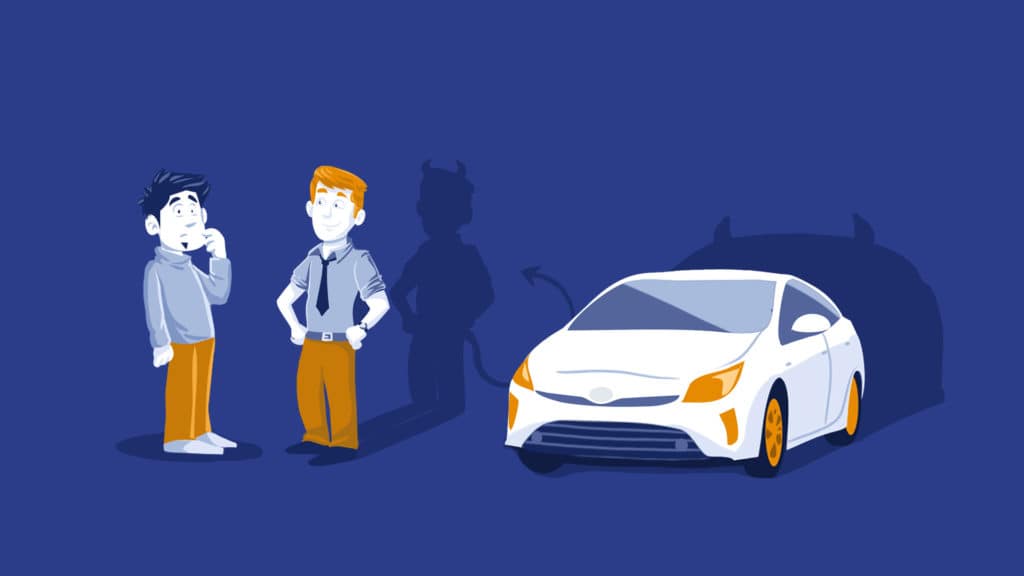

The Delhi Police recently detained a group of online offenders who were using sites like Olx to post classified ads. The gang was nabbed by the Vivek Vihar cyber team after a victim reported losing Rs 71,949 while purchasing a used car through Olx. Scams have been occurring on websites like Olx, Quikr, and others for a while. It has been stated that some educated city dwellers have fallen victim to these frauds. Be aware that these frauds don't actually include websites like Olx and Quikr. The general public's ignorance of app-based payment services and UPI is a major contributing factor to the prevalence of these scams. Here is all the information you need to know about the "huge fraud" when utilising Quikr and Olx.

You will receive a call from a potential buyer as soon as you place your ad on Olx or Quikr, and in some cases nearly instantly

When you place an advertisement on Quikr or Olx for whatever you want to sell, like a bicycle, sofa, or car, you immediately receive a call from a "interested buyer" on the mobile number provided in the advertisement.

The "prospective buyer" won't haggle over the phone. Typically, he readily agrees to any payment you request for selling your item.

When someone purchases something through Olx or Quikr, haggling is frequently used. In this instance, though, the caller will likely not barter at all and may accept the price you offer for the commodity you are selling.

On the phone, the "prospective buyer" won't bargain. He usually readily accepts any payment you demand in exchange for selling your item.

Haggling is frequently employed when someone purchases something through Olx or Quikr. However, in this situation, the caller is more likely to accept the price you provide for the good you are selling rather than bartering at all.

The caller will attempt to use UPI to send the money to reserve the item.

Here's where the con begins. On UPI, the complete fraud takes place. After settling on the pricing, the caller will explain that he or she would use Google Pay, PhonePe, or another UPI service to send the entire amount or some booking money.

The caller will ask for money from you using UPI rather than sending you money. Instead of transferring money, the fraudster will seek for money from you using the UPI apps' "Request Money" option. This is where folks lose their money, so take note. They simply click on the SMS from UPI apps without properly reading it, and the money is moved from your account.

The caller can even receive an OTP for your account rather than his to approve the payment.

Paytm and other UPI applications offer you an OTP to confirm the payment to a shopkeeper in order to protect merchant payments. The fraud caller in this scenario might utilise a merchant account to generate an OTP for a debit from your account and will request it. Never give somebody an OTP over the phone. Always be aware that when you withdraw money from your account, OTPs are produced. You will never receive an OTP if someone adds or moves money into your account.

Avoid making previous online purchases to "book" an item. Always meet the person in person before making a deal to avoid any risks. Always tell the buyer to meet in person when selling anything on Olx or Quikr to remain safe. This is because the buyer must ultimately see you in order to purchase the item that you are selling. After all of that, meet the individual with prudence and common sense, and wait to give them your home address until it is absolutely required.

How to avoid these types of scams

1. Verify details of buyer/seller before proceeding to payment.

2. Any individual showing urgency or not waiting for a reasonable amount of time is likely to be a scammer.

3. You should never scan a QR code, share an OTP, or visit a link given by anyone on the internet.

4. Your One Time Password (OTP), UPI pin, and other secret information should not be shared on WhatsApp. Never provide banking information if anyone asks you to and always contact your bank. There is a possibility of fraud here.

5. It is recommended that digital escrow platforms be used for payment. When making an online payment with Escrow, you do not share your financial information with anyone. There is a platform for escrow called Vouch.

How does digital escrow work?

In digital escrow, a third-party account holds the money deposited by the buyer until the seller fulfills the terms of the contract. The escrow company supervises the transacting parties.

What is the role of Digital Escrow in preventing online fraud in India?

Digital escrow services are offered by many companies in India. Among the most trusted is Vouch.

Vouch’s Digital Escrow service is a transparent way for buyers and sellers to build trust and secure a clean transfer of product and payment. Sellers can feel assured that they will be fairly compensated promptly, and buyers will feel confident that their order will be delivered as expected and on schedule. Vouch Digital Escrow keeps you updated and informed at every step of the transaction process till the end. Vouch’s professionals are always available to assist you with all queries that you may have during the entire transaction process.

There is no scope for deceit or fraud since the payments, shipping, delivery, and execution are carried out under the honest and watchful eyes of the Vouch’s professionals. With Vouch, any business transaction becomes transparent, uncomplicated, and hassle-free. If you ever come across a fraudster asking for OTP, asking you to scan a QR code, or asking you to click on phishing links, you can simply refuse and ask him/her to proceed with the transaction through Vouch.

This is Fraud Story #237. Check back here for more fraud stories and scams that you can protect yourself from.

Safety is not just about protecting your credit, debit card number, and UPI accounts. It's about having control of your money till you've received the product or service you bought online!

Note: This is a good-faith initiative to educate the world about avoiding frauds like these and how to act when you're becoming a victim of such a situation.

Do you have a fraud you would like to report? Please write to us at letstalk@iamvouched.com