Tax Scams that tax you twice

Do you remember your first salary slip or payslip or paycheck? If you are someone like the writer of this particular blog, you were in a rude shock. Your employment letter said you were going to be paid Rs.X per month. When you received your first pay, you had mixed feelings of joy and sorrow. Not joy and happiness. This is because you were in for one of the nastiest surprises that greets a new employee.

You could not believe your eyes. What you thought you were going to receive and what you actually received were vastly different. If you expected Rs.X, you ended up receiving something like Rs.X - a big fat 40%. And that as your friendly accountant at your employer may have said - is taxes.

As Benjamin Franklin once famously said, the only things certain in life and death and taxes. And once you realize the futility of your efforts to do away with taxes, you start planning to reduce your taxes as much as possible legally.

Taxes and payments reduced from paychecks and invoices take a variety of shapes and forms - Taxes Deducted at Source (TDS), Value Added Tax (VAT), Goods and Services Tax (GST),Withholding Tax, Group Insurance Policy payments, loan payments deducted at source by employer, provident fund (PF) or retirement fund payments such as 401K. The list gets longer depending on the benefits, services and things that an employee or supplier has agreed to.

The Common Threads in Tax Scams

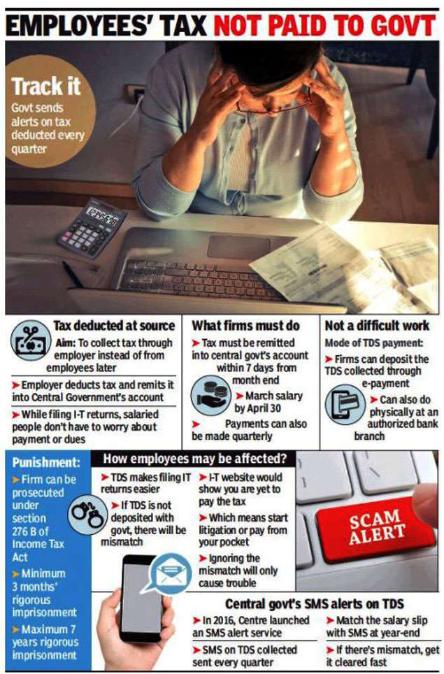

All the taxes or payments and deductions that we have discussed above have one thing in common - they are all reduced from your monthly or periodic paycheck or payment by your employer or supplier and remitted to the respective government organization. For instance, in India, Provident Fund is to be remitted with employer matching to the Employees Provident Fund Organization (EPFO), TDS has to be remitted with the Central Board of Direct Taxes (CBDT), GST has to be remitted to the Central Board of Excise and Customs or GST Authority.

The common threads in Tax scams are:

1. The deduction is applied but the funds are never remitted with the government organization

2. The deduction is applied but only a partial amount is remitted with the government organization

3. The deduction is applied but wrongly remitted to another account

4. The deduction is applied but funds are diverted to other purposes

5. The deduction is applied because the company is short of funds

The main problem with these types of scams is that the problem is uncovered only when it's time to file a tax return. And sometimes, by then, it is too late.

The reasons could be several -

1. The employer may no longer be a viable business

2. The employer or deductor may no longer have the funds

3. Funds may have already been misused for other purposes

4. Time to take action has passed - for instance, if insurance policy payment was not made - you cant pay at the time of availing the policy benefit or policy has lapsed

This results in one and only one thing - you are now taxed twice for something that you are not even responsible for. You may even owe additional payments such as penalties, interest, and other punitive payments.

The Rs.3200 Crore TDS Scam

Let's understand the details of an Rs.3200 Crore scam unearthed by India's Income Tax authorities in the year 2018. 447 entities deducted taxes and diverted money for other purposes including but not limited to their own business needs. Parties that perpetrated this fraud include builders, movie production houses, infrastructure companies, startups amongst others.

Authorities maintain that it is not possible to hoodwink the system as everything is digitally connected. Non-remittance of tax deductions attracts severe penalties in the form of criminal and civil liabilities not to mention additional punitive payments. Yet, employers and entities continue to resort to both fraud and delay tactics.

Under the Income Tax Act, failure to pay TDS "shall be punishable with rigorous imprisonment, which shall not be less than 3 months but which may extend to 7 years" along with a fine.

GST Scam

Another type of tax scam is the GST scam. In the GST scam, the service provider has the obligation to remit the GST collected to the government. The GST system has a concept called matching which enables the buyer to dispute the invoice if the tax paid does not match the tax remitted. Yet, given the myriad number of follow-ups required, most people don't follow due to the absence of a foolproof system to protect people and their money.

Protecting oneself from TDS and GST Fraud

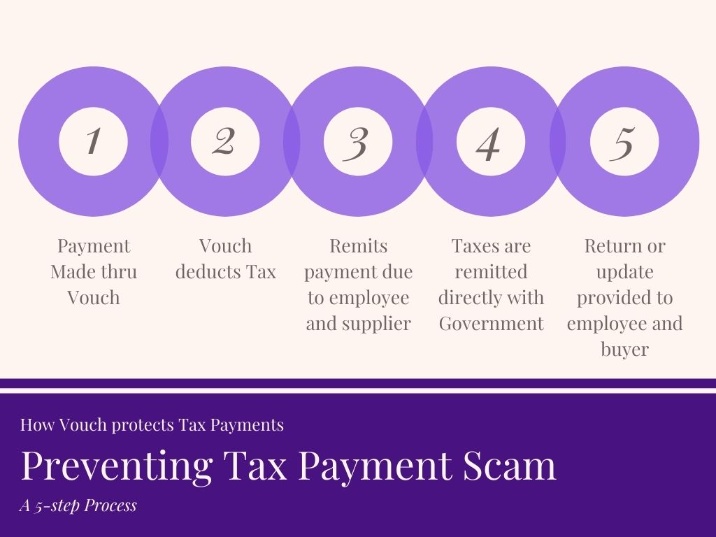

Can one protect oneself from TDS and GST fraud and other similar tax non-payment or underpayment frauds? Yes, they can. This is how they can:

1. Check the amount of taxes deducted

2. Sign up for a notification service, if any, to check the status of payments - in most cases, these don't provide monthly and timely updates and may hence not be completely useful

3. Insist on payments getting routed thru a payment platform such as Vouch

Why is the Vouch method foolproof? All payments made to Vouch are managed using an Escrow account administered by a Trustee and Guaranteed by a Bank. This prevents any diversion or misuse.

· · ·

This is Fraud Story #25. Check back here for more fraud stories and scams that you can protect yourself from.

Safety is not just about protecting your credit or debit card number. It's about having control of your money till you've got what you wanted!

--------------------------------------------------------------------------------

Note: This is a good-faith initiative to educate the world about how to avoid frauds like these. Do you have a fraud that you would like to report? Please write to us at letstalk@iamvouched.com