It is common to hear about OTP frauds and people losing money through QR barcode scams or clicking on a link. There are a thousand ways scammers today exploit people over the internet. Being aware of these ways will save money.

It is true that many people think posting on Facebook can help them regain what they've lost. But that isn't how it works. Whatever you lose online, whether it is money or products as a seller, it is highly unlikely that you can recover it until you use an escrow payment service.

A new trick to scam people in the name of UPI transactions.

Conventional wisdom states that sellers over the internet for all intents and purposes ask for screenshots of payments while doing business through particularly social media, However, have you ever heard of a buyer sending a fake screenshot of payment through Google Pay?

Oftentimes, bulk sellers and people who get a large number of orders daily do not think about checking with their banks and end up sending goods without the buyers ever making a payment to them.

Story of Shreya, a facebook seller.

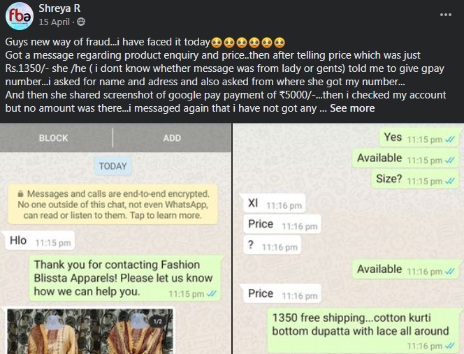

Shreya is an online business owner who runs Fashion Blissta apparel. She logged onto WhatsApp to see what new messages she had received from an unknown number.

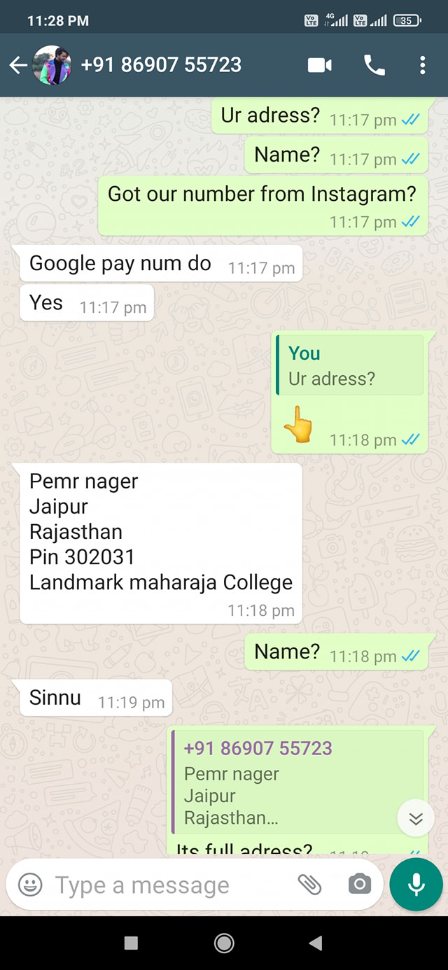

Apparently, the message was from a guy inquiring about a dress she posted on Instagram. Shreya informed him about the price and asked for his name and address. Despite her repeated messages, he kept asking for her Google pay number in order to proceed with the payment.

Having been interrogated all day, the guy finally gave Shreya his address and requested the payment details to make the payment. Any new buyer of a product would be expected to inquire about the payment, delivery, and all other necessary details from the seller before committing to purchase. By his insistent tone, it was absolutely clear that he was a fraudster.

Paid 5000 instead of 1350

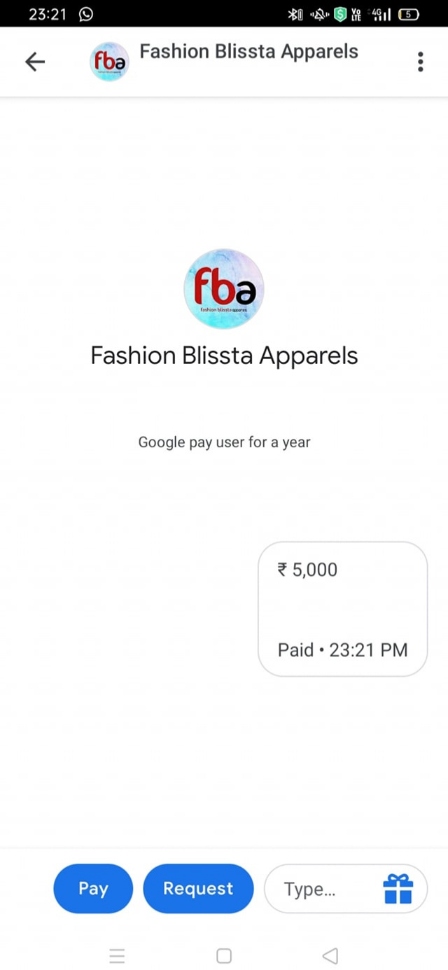

Following Shreya's payment details, he sent a screenshot stating that he had made the payment and that Shreya could proceed with the order.

As Shreya reviewed the screenshot he had sent, she found that he paid 5000 instead of 1350 rupees. Because of her innocence, she had no choice but to inform him of his mistake and let him take the money back.

Caught red-handed

The fraudster replied 'OK' upon Shreya's information, which caused her to reconsider what she was about to do. Her second check revealed that the screenshot was fake and there was no arrow next to the payment.

Upon reviewing the screenshot and observing his strange behavior, Shreya knew she was being scammed. Immediately following this experience, she took to Facebook to warn others about the new way scammers are using to scam people online.

The majority of scams are perpetrated by sellers. Either the seller does not send the product or the buyer receives a defective or fake product. Despite this, a lot of disputes on the internet lead to buyers getting scammed by fraudsters. It usually occurs with sellers too, mostly with the ones who do not bother checking whether they have actually received payment.

A seller who blindly trusts the buyer might end up paying the price.

As cashless India becomes a reality, no one on the internet is worth trusting. There are a large number of scams reported each year, and they are on the rise.

Frauds > coronavirus

In addition to protecting oneself from Coronaviruses, one must keep an eye out for cybercriminals. Financial transactions conducted on the internet by users are common targets for these criminals.

Mobile devices are becoming increasingly popular for making cashless, real-time payments through Unified Payment Interfaces (UPIs), a network infrastructure that facilitates cashless, real-time transactions.

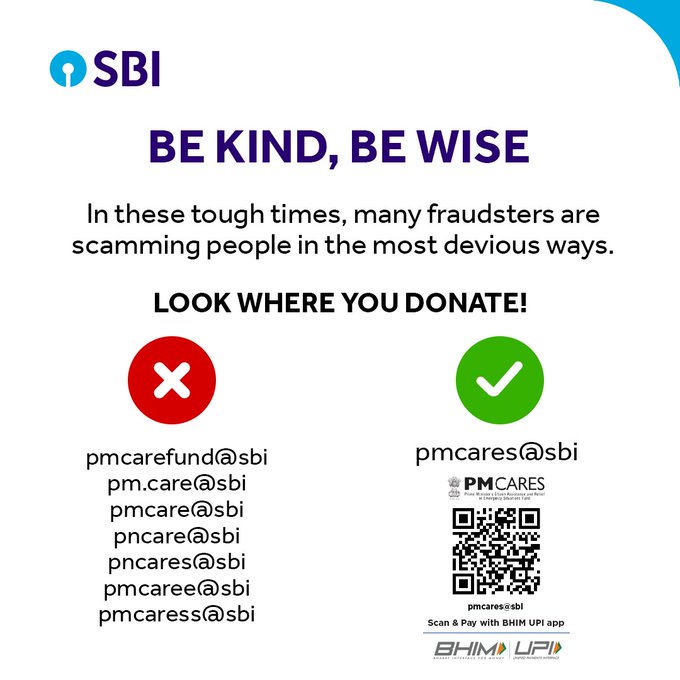

In the wake of these frauds, banks now have started to warn people on Twitter to avoid falling for scams.

A Tweet from SBI for your reference

Unauthorized payment links can be sent to your mobile phone via SMS by fraudsters. In almost every regard, these fake bank URLs look identical to the real thing. The UPI payment app installed on your phone will direct you to that link if you click on it in a hurry and will ask you to choose which apps to debit automatically. You will immediately see the amount get deducted from your UPI app once your permission is granted.

The following tips will help you protect your money against fraud.

- In no case do government agencies, banks, or other financial institutions request financial information via SMS. In the case of UPI fraud, you should contact your bank or eWallet company and request the wallet be blocked in order to prevent further losses.

- Police or the cybercrime cell can even be contacted about the incident.

- When using the digital payments app, you will probably receive a spam warning. Do not ignore it. The warning would appear if you transact with someone who had been reported earlier.

- Using digital escrow platforms as a payment method is preferred. When you pay through an Escrow payment system over the internet, you are not sharing your information with strangers. One such platform for escrow is Vouch

This is Fraud Story #29. Check back here for more fraud chronicles and scams that you can protect yourself from.

Safety is not just about protecting your credit or debit card number. It's about having control of your money till you've received the product or service you bought online!

-------------------------------------------------------------------------------

Note: This is a good-faith initiative to educate the world about how to avoid frauds like these. Do you have a fraud that you would like to report? Please write to us at letstalk@iamvouched.com