How Sanket got Conned

All of us come across work from home advertisements. Most of them are Multi-Level Marketing (MLM) schemes or Ponzi schemes. Some are money laundering businesses, some are check discounting businesses, and so on. While there are a limited number of genuine programs, most of them are frauds.

The success of platforms such as GloRoad and Meesho that have capitalized on the sharing behavior of users and built entire platforms around them, some unscrupulous operators have used this behavior to create dubious work-from-home schemes. From clicking links to forwarding links to calling leads, work-from-home scams and frauds have come off age. One such scam caught a young man in its crosshairs.

Sanket is a happy-go-lucky young man. He came across a message that Amazon was recruiting part-time workers to increase the click-through rate for its items. Wondering what a click-through rate is? The Click-through rate is the number of users who have clicked on a product and visited its listing page. The greater the number of such click-throughs, the higher the ranking of the product.

Pay to Play - The worst fraud of its kind

When Surbhi of CC Mall contacted Sanket and outlined a way to work from home and earn money by clicking links, he was pleased. Sanket felt what one feels when one hears something like this - being paid for an activity that one seemingly does every day. It felt like magic.

On days 1 and 2, he clicked thru certain products and earned a commission of Rs.1,500 on orders of Rs.5,000. It was a hefty 30%. Nothing sent alarm bells ringing in Sanket's mind as he was happy counting his money.

On day 3, they sent him an offer:

Again, nothing rang alarm bells within Sanket's mind. Since he had already been paid Rs.1,500, CC Mall had earned his trust. They earned his trust and now turned to prey on his greed. Again, nothing sent alarm bells ringing in Sanket's mind when he was asked to pay to play. He was asked to deposit money to earn money for a routine action - increasing the click-through rate.

The greed within him egged him to go for the highest tier. He deposited Rs.43,000 to earn the highest commission. His money is now stuck and he is now stuck. CC Mall has frozen all his money citing non-completion of tasks. He has nowhere to go now since it looks like the company has used all the right tactics to fleece him of his money.

The Problem with Ponzi Schemes

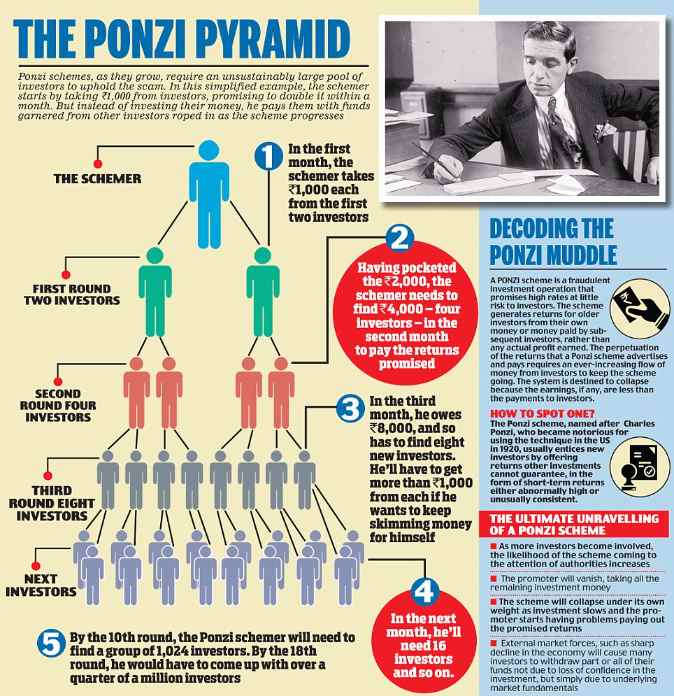

This is a typical Ponzi Scheme. It asks the individual to do something effortless - in this case, clicking links. It used a well-known name - Amazon. It promised high returns - 30%. Finally, to seal it all in - it paid him Rs.1,500 within the first 2 days which made him feel that it was genuine. The problem is that it came too easy.

Amazon does run an affiliate program and depending on the item, provides an affiliate fee of 5-15% of the product's actual selling price. One can easily sign up to be an affiliate on Amazon and after completing the requisite KYC, earn the money according to periodic intervals. In this case, Sanket was being paid just for a click-through. And if someone was paid 30% commission just for a click-through, what would the ultimate seller and Amazon, the alleged platform here, get?

It sounds too good to be true. Sanket should have seen this coming from a mile away. In this case, CC Mall has taken his money and just like it earned his trust by paying him Rs.1,500, it is using his own money to pay someone like him.

What's Ponzi?

The name Ponzi comes from one of the first people who scammed Americans in the 1920s with a fake stamps scam - Charles Ponzi. Ever since then, the methodology used by him has been used several times over.

In Bangalore alone there is a scam called Vini Vink run by a reputed priest - K N Srinivas Shastry that run into more than Rs. 400 crores. He promised 40% returns and ran away with a few hundred crores after paying the first few installments. Recently, a Gold Jewelry chain - IMA Jewels, again in Bangalore did something identical and siphoned off money. No matter what the scheme is, if it hits one of the above 5 signals, you should smell a Ponzi scheme. Read below to understand how economics work. And almost always, the first 2-3 times, the fraudster will pay the first few promised installments to earn your trust. Just a tad above what will earn your trust. Don't fall for it,

How can you stop yourself from suffering a Ponzi Fraud?

1. Ignore - 99 out of 100 times, don't sign up for it. Don't even listen to their pitch.

2. Signals - Check the 5 signals above

3. References - Ask for names of real people who actually earned the money. Ask for additional proof till you are satisfied

4. Search - Look up their digital footprint. Run Google Searches to find out if what they are claiming is true

5. Digital Escrow - Route money through a digital escrow. Remember, once money leaves your hand, its almost impossible to get it back.

Its a fraud, fraud, fraud world

Frauds are not a new thing. Frauds and scams are as old as humanity. During the olden days, frauds fell into categories where coins were minted by people other than the king. The king's seals were faked or copied. Coins were melted and mixed with other metals and lower purity coins with the same seal of the king were distributed.

Other frauds included faking the king's signature etc., Due to the nature of these frauds, punishments were severe. Hands were chopped, people were guillotined, people were banished to far-off places. Those were the days of kings where one person was the supreme authority. However, as the world has evolved so have frauds.

Today, with the advent of democracies, there is no single organization that helps prevent fraud. Most people visit the local police station which rarely comes to their help. Running around courts, lawyers etc., only results in more waste of time, effort and money. Not to mention the anxiety that comes along and the uncertainty of the outcome.

So, the best then one can do is use a digital escrow platform to protect their money. Ask the organization to run it thru a digital escrow to take control of the process and protect yourself.

How does Digital Escrow save you from online frauds in India?

Safety is not just about protecting your credit or debit card number. It's about having control of your money!

-------------------------------------------------------------------------------- Note: This is a good-faith initiative to educate the world about how to avoid frauds like these. Do you have a fraud that you would like to report? Please write to us at letstalk@iamvouched.com