Digital payments - fast but risky!

Since Google Pay, PhonePe, and other apps such as UPI have become so popular, transferring money has become very convenient. Yet while UPI has facilitated a new way for consumers to pay digitally, it has also made it easier for scammers to exploit unsuspecting consumers. In an attempt to sell his bike on OLX, a man came across a fraudster.

The OLX bike scam

It all began when the victim, who lives in a small town in Uttar Pradesh, received a call from someone claiming to be from a nearby city, and asking about purchasing the motorcycle. Aside from paying Rs 10,000 in advance, he said he would pay the rest of the amount in cash when he picked it up two days later.

Despite assurances that the man would not enter into any other agreements during the period in question, the person insisted on paying the advance. In the meantime, the caller wanted the recipient's UPI address so the amount could be sent. The man was suspicious enough to cut him off.

Within an hour of refreshing the listing, he received a call, and exactly the same thing occurred in the following week. Despite being certain that it was a fraud, he did not understand how giving up his UPI ID alone would result in a scam.

How to detect it?

You are told that the scammer has sent the money, please accept it. Putting your finger on 'Pay' will result in getting the money while tapping on 'Decline' will result in the transaction being rescinded. Receivers of UPI transactions need not do anything to receive funds. Due to ignorance, people end up paying the scammer in order to receive the money. UPI fraud is the result of this small negligence on your part.

How it happens?

Following your disclosure of your UPI ID, the fraudster will send you a payment request. Rather than transferring the funds promised to transfer for the item you listed on the classified site, the scammer might send a request demanding payment.

What to do if you get a call from such a scammer?

- Verify details of buyer/seller before proceeding to payment.

- Any individual showing urgency or not waiting for a reasonable amount of time is likely to be a scammer.

- Don't scan a QR Code or visit a link sent by anybody over the internet.

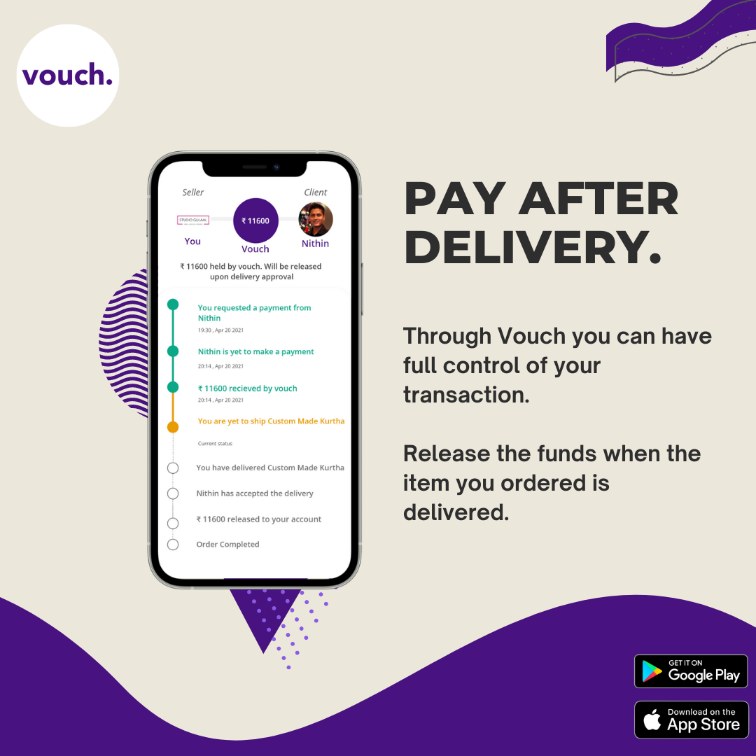

- Avoid accepting or making advance payment. Accept only if the payment is made through escrow payment platforms like Vouch. In case you are the one who's supposed to pay - Do it through Vouch.

- Fraudsters use fake identification of the army to gain trust. Keep a check on such attempts.

-1624020024786-compressed.png)

How does Digital Escrow save you from online frauds?

This is Fraud Story #59. Check back here for more fraud chronicles and scams that you can protect yourself from.

Safety is not just about protecting your credit or debit card number. It's about having control of your money till you've received the product or service you bought online!

--------------------------------------------------------------------------------

Note: This is a good-faith initiative to educate the world about how to avoid frauds like these. Do you have a fraud that you would like to report? Please write to us at letstalk@iamvouched.com