The Indian e-commerce market has been expanding rapidly, and by 2034, it is anticipated to overtake the United States as the second-largest e-commerce market in the world. However, given the Covid-19 pandemic's significant digital push, increasing smartphone penetration, and improved connection outside of tier 1 cities, India's rapid adoption of digital payments should not come as a surprise.

The government's Open Network Digital Commerce, Government e-Marketplace portal, National Retail Policy, and Digital India programmes, which encourage innovation from domestic public and private businesses and draw sizable foreign investments to support this growth, are just a few of the many factors boosting India's e-commerce sector.

All things considered, adopting the best digital payments strategy and successfully implementing it will set those who succeed apart from those who fall behind. This is because digital payments are essential to the customer buying process on e-commerce platforms and have a significant impact on purchases made at the register. Cart abandonment, which occurs when a prospective consumer begins the checkout process for an online order but leaves the process before finishing the purchase, is one of the largest problems with online selling.

Solutions to this conundrum.

Offer smoother, quicker payments.

Newer technologies like click and collect, which allow customers to pay online and pick up their purchases offline, gained popularity during the pandemic because they reduced the need for human interaction and separated the size of the basket from the amount of time spent in line to process the order and make the payment. Due to their simplicity and convenience, one-click payment options made available through digital wallets and mobile wallets also increase sales conversion. The fact that digital wallets will account for the majority of Indian e-commerce transaction value (45%) in 2021 is evidence of the superior user experience that it offers consumers.

Reduce risk and encourage spending.

Presenting a localised view of your shopping website while customers are making purchases on international websites is essential for winning their trust and securing their business. A similar safety net for consumers is a convenient returns policy, which affects more than 90% of consumers' decisions about whether to purchase products and services as well as a similar percentage of consumers' decisions about how much they will spend. Offering incentives, such as free shipping for larger basket sizes or a discount for new customers, is another successful strategy for promoting larger purchases and conversion. These strategies are especially effective when the risk of making the purchase is reduced by combining them with an easy returns policy.

Provide more options for financing and payments.

According to studies by Worldpay from FIS, platforms must enable the customers' chosen payment options in order to convert that sale because it makes purchasing more convenient. A startling 41% of customers claimed they would abandon their shopping cart if their chosen payment option wasn't offered, and 65% of those customers would simply purchase the identical item from a rival who does.

In more recent times, the availability of financing options like Buy Now Pay Later (BNPL), which allows the customer to own the goods immediately and pay for them over an interest-free instalment period, has been a strong influencing factor on basket size and conversion, with 30% of customers declaring they won't complete a purchase if BNPL option is not available and merchants having observed 10-15% more purchases completed by customers when they offer a BNPL payment method.

Adopt cybersecurity and fraud prevention measures, but refrain from turning away loyal customers.

With the recent release of tokenization rules to further strengthen the protection of payment data, tokenization is becoming more and more popular around the world. This is also the case in India. Private information like payment account numbers are replaced with a token, a collection of random numbers, thanks to technology. When a credit card is swiped, dipped, or entered online, this personal data is tokenized, and the real data the token refers to is stored in extremely secure token vaults.

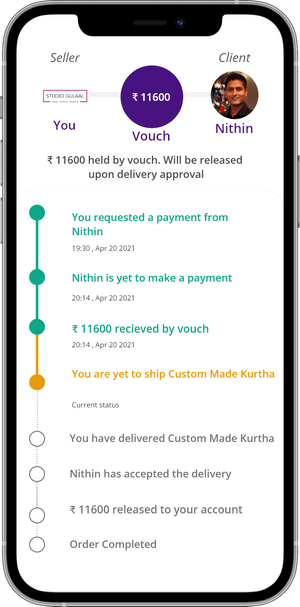

E-commerce stores can also offer a "Release on Delivery" (ROD) payment service provided by VOUCH is an alternative to "cash on delivery," as it protects the interests of the merchant and safeguards the rights of the customer.

How does it work?

As part of this system, buyers can choose the RoD payment method and make payments using credit cards, debit cards, or net banking. In turn, the RoD method ensures that the money of the buyer will be totally safe in an escrow account. In this way, the seller becomes confident that the buyer will pay. Only after the buyer gives instruction to the escrow company to release the money upon delivery of the product is the payment released. There is also a dispute resolution team that deals with all product and delivery issues.

It appears that this is a great service that not only protects buyers, but also makes it easy for merchants to convert those who choose cash on delivery due to trust issues to try out online payments safely.

Get to know what you should avoid in order to look genuine to new customer.

There are no signs that the e-commerce sector's remarkable development will slow down. Payments are an essential component of buying and have a big impact on how much a potential customer will spend and if they will actually complete the deal. The key is giving clients a hassle-free shopping and payment experience. Successful e-commerce platforms will be those that fulfil the rising expectations of customers in terms of a seamless experience as online shopping continues to expand faster than point-of-sale buying.