What Is the Function of a Third-Party Payment Processor?

A third-party payment processor will not deposit funds into your merchant account. Instead, it receives funds through its merchant accounts. They then deposit it in your bank account.

This means that you can use a merchant account even if you don't have one.

Let's take a closer look at how a third-party payment processor works.

Card Authentication

The payment processor begins by verifying the account number of the cardholder.

This is done to ensure that the card is valid and part of a 3D secure platform. For confirmation, the merchant server software contacts the card network.

Authorization by the Payer

To begin authentication, the merchant plug-in sends the Payer Authentication Request/Response (PAReq/PARes) to the Access Control Server (ACS). The ACS is a server that the issuing bank has set up.

The CVV of the cardholder is verified here.

An Accountholder Authentication Value (AAV) is generated if the authentication is successful. The AAV is delivered to the merchant as part of the PARes message. As a result, the merchant sends this AAV to the acquirer. It is then forwarded to the issuing bank. It is included in the authorization request.

AAV values must be presented by ACS providers for all attempts.

The transaction Status is Y if the Authentication determined by the Issuer's ACS is successful. (Y = PARes)

The transaction Status is N if the authentication determined by the Issuer's ACS fails. (N = PARes)

However, it is possible that the authentication was unable to be completed for a variety of reasons. Perhaps the ACS was unable to process the authentication request message. It is also possible that there was a system failure. The transaction Status is U in this case (PARes = N).

After successful authentication, payment authorization is carried out. The merchant submits a payment request to the acquirer or third-party payment processor. For example, Cashfree. Following that, the third-party payment processor sends the request to the credit card company or the account holder's bank.

If there are sufficient funds, authorization is granted and funds are deducted. When using a debit card, the credit line is reduced by the amount of the sale.

Capture

The card network notifies the Issuer bank and Merchant plug-in that the card has been authorized. Following that, money is transferred from the customer account to the merchant account.

As previously stated, funds are deducted during authorization. As a result, the corresponding amount is subtracted from the credit line/account balance and transferred to the merchant's account.

The time between authorization and capture may differ depending on the PSP (payment solutions provider).

The Advantages and Drawbacks of Third-Party Payment Processors

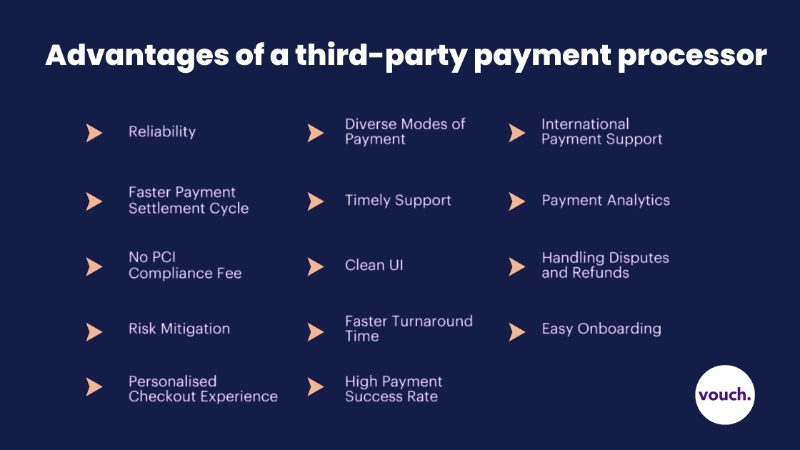

Incorporating a third-party payment gateway is a fraction of the cost of opening a merchant account. However, that is not the only advantage of working with them. Let us go over some of these advantages.

The Benefits of Third-Party Payment Processors

Here are some of the advantages of using a third-party payment processor for your business:

There is no PCI Compliance Fee.

You don't have to be concerned about the security of your payments when you use tpp third-party payment processors.

They maintain the strictest security measures to protect customer data. As a result, you won't have to worry about PCI compliance or any other fees on your own.

Better user experience

Did you know that if you invest $1 in UX, you can get $100 in results? That's a 9900% return on investment!

Tpp payment processors typically provide optimized checkout pages. They are usually light for slow internet connections and work well on mobile. As a result, checkout times are reduced and drop-offs are reduced.

Refunds and Disputes

Disputes and refunds are common occurrences in business. More importantly, they are required for an effective customer service strategy. In fact, 95% of consumers believe that customer service influences their brand choice and loyalty.

Money transactions are handled on your behalf by a third-party payment processor. It also includes handling customer complaints and refund requests. Their effectiveness in handling customer complaints contributes to the success of your company.

Risk Reduction

Because buyers and sellers do not know each other, online transactions are risky.

Tpp payment processors deal with large volumes of transactions daily. They also have engines that detect potentially risky transactions. Detecting and rejecting such fraudulent transactions protects your company from risk and financial loss.

Drawbacks

There is less room for customization.

A dedicated merchant account may allow you to make the smallest of changes. When working with third parties, there is less room for customization. There are limitations to the checkout pages, pricing, and other integrations you desire.

Higher Initial Investment

A third-party payment processor has a higher setup cost than the traditional method. It does, however, save you about a year of testing and selecting all of the tools you would need for your payments.

Is a Third-Party Payment Processor Required?

So, what are our thoughts? In the early stages of your business, a third-party payment processor is a viable option. However, it is critical to select one that meets all of your company's requirements. So, be aware of your needs and the existing regulations, and weigh all factors before making an informed decision.