Payment gateways are used by all online businesses to collect payments from their customers. This is the most convenient method of collecting payments from customers because payment gateways are integrated with all banks, allowing them to transfer money from customers' bank accounts to merchants' bank accounts after deducting their charges and applicable taxes.

A company may begin with only one payment gateway, but over time, in order to increase resilience and obtain better rates, companies add multiple payment gateways to their websites and apps. This ensures that even if one payment gateway's service is unavailable, the business is not harmed because traffic can be routed to other payment gateways.

Reconciliation is the process of ensuring that the amount in the Accounting Systems corresponds to the amount in the Payment Gateways and Commercial Transactions Statements, as well as any other relevant account details that may be required. The irrelevant information could also take the form of income tax.

However, during the entire process of collecting payments from customers, reconciliation is a difficult activity in which the Finance team must verify whether the sale recorded has resulted in a settlement or not.

What is reconciliation?

Reconciliation enables the user's finance departments to ensure that the amounts listed in the document are included in their account book and include a brief description of any unacknowledged items. The reconciliation process includes a mechanism to ensure that the transfers are still being handled, but that they are being handled correctly.

Clients can immediately gain visibility into any anomalies somewhere along the transaction lifespan by putting all details into a common database and comparing purchases at each stage in the time frame. They also have the ability to deal with any issues directly, as well as the leverage to go back to third parties and force them to change their behavior and/or lower their prices.

What might be the problems with reconciliation?

Payments are produced from online and offline channels and handled through the portal for merchants who issue a large number of invoices and orders on a regular basis. At the end of the day, the gateway transfers the entire balance (as a lump sum).

The full balance is also transferred over a few weeks, depending on the gateway, with no reference to the initial invoices or orders from which the transactions are collected.

Problems with the payment gateway reconciliation process:

- Integration of multiple payment gateways

- Each Payment gateway has its own settlement report format.

- Downloading data manually via payment gateway portals and dashboards

- Order IDs can be extracted from PG reports.

- Before reconciling data, clean and standardize it.

- For reconciliation, use complicated formulas.

- The outcome is spread across multiple Excel files.

- Difficulty in sharing and analyzing results with colleagues

- Repeat the manual process daily, or reduce the reconciliation activity to once a week or once a month due to a lack of bandwidth.

Reconciling Your Merchant Account

There are several methods for reconciling the merchant account. The process of reconciliation could be formal or informal. You'll need to keep track of and review your transactions from each source. The sources could be a bank record or your own.

After reviewing the transactions, you must compare the payments to the available balance in your account. The merchant environment is important in reconciling your merchant activity.

Payment reconciliation in real-time

The Cloud factors API integration interface is used to enable real-time reconciliation of money transactions with Netsuite, Quickbooks, or any other enterprise systems, including a history of transactions with transaction IDs recorded on the gateway. Merchant clients must select the information they require and the format in which it is presented in order for it to be more easily integrated with their preferred financial statements.

The total balance remaining for transfer to the Gateway Report will then be moved to the actual Bank Account, as is customary after all expenses and returns are completed with the Gateway bank account and Statements.

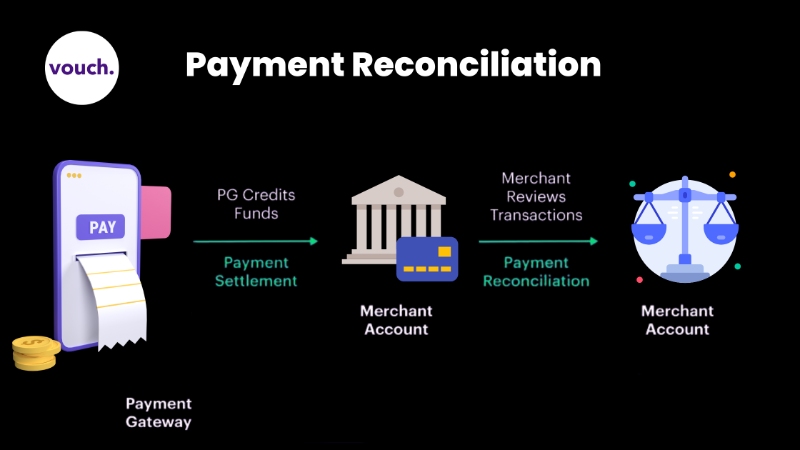

What is the difference between reconciliation and payment settlement?

Most businesses now fail to recognize the distinction between settlement and payment reconciliation. Understanding the distinction can help you do business more effectively.

Each payment gateway has its own settlement cycle. A settlement is when a payment gateway credits funds to a company's merchant account. A settlement is the period of time between when customers pay and when the funds are received by the merchant account.

Payment reconciliation, on the other hand, refers to the process of reviewing all business transactions, including income and expenses.

Conclusion

Payments Reconciliation may not have to be as difficult as it appears. Nowadays, a set of tools has been put in place to make reconciliation as painless for accounting professionals as possible. However, dealing with the issues raised above remains a difficult task.

To truly simplify reconciliation, investors must assist their merchants in effectively dealing with these challenges by removing the fundamentally complex issues of reconciliation.

To know more about payment gateways read - Do I need a payment gateway?